Our tokenization solution offers institutional investors broad access to private market assets

$16.3 trillion of assets will be tokenized by 2030

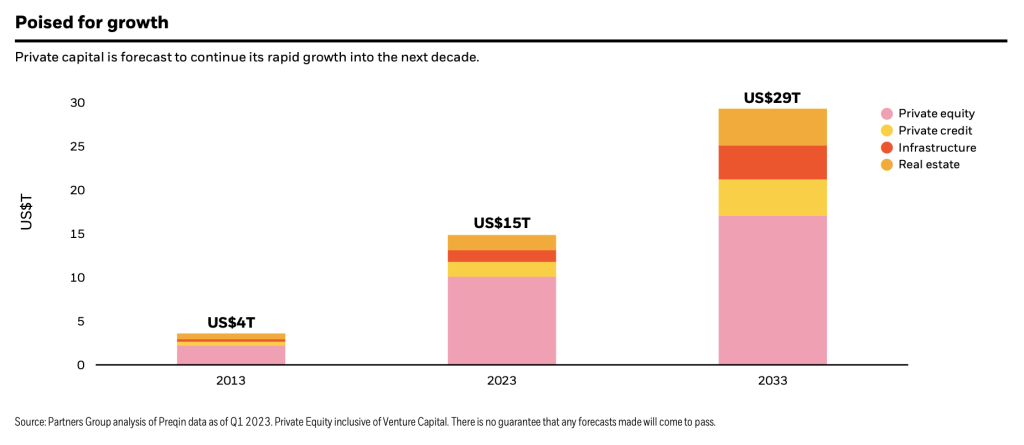

Private markets forecasted to reach USD 29T by 2033

Private markets are evolving quickly, giving more investors access to institutional-quality opportunities. Partners Group predicts private capital will nearly double, growing from USD 15 trillion to USD 29 trillion by 2033, driven largely by growth in private equity, private credit, infrastructure, and real estate. Boston Consulting Group forecasts that assets under management (AUM) in private equity, private debt, and infrastructure will grow by over 10% annually between 2023 and 2028.

Private market growth forecasts (source: Blackrock/Partners Group)

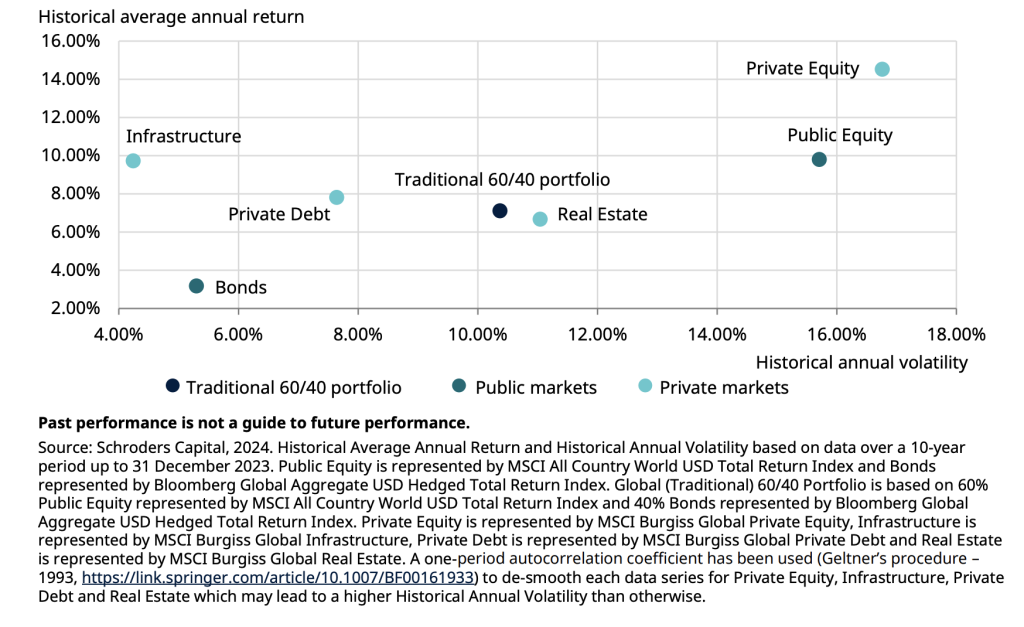

Private markets have historically reduced overall portfolio volatility

Private assets have historically offered valuable diversification, helping to reduce overall portfolio volatility. As shown in in the illustration below, over the past 10 years, private equity, private credit, infrastructure, and real estate have delivered attractive risk-return profiles.

Historical annual returns vs annual volatility (source: Schroders Capital)

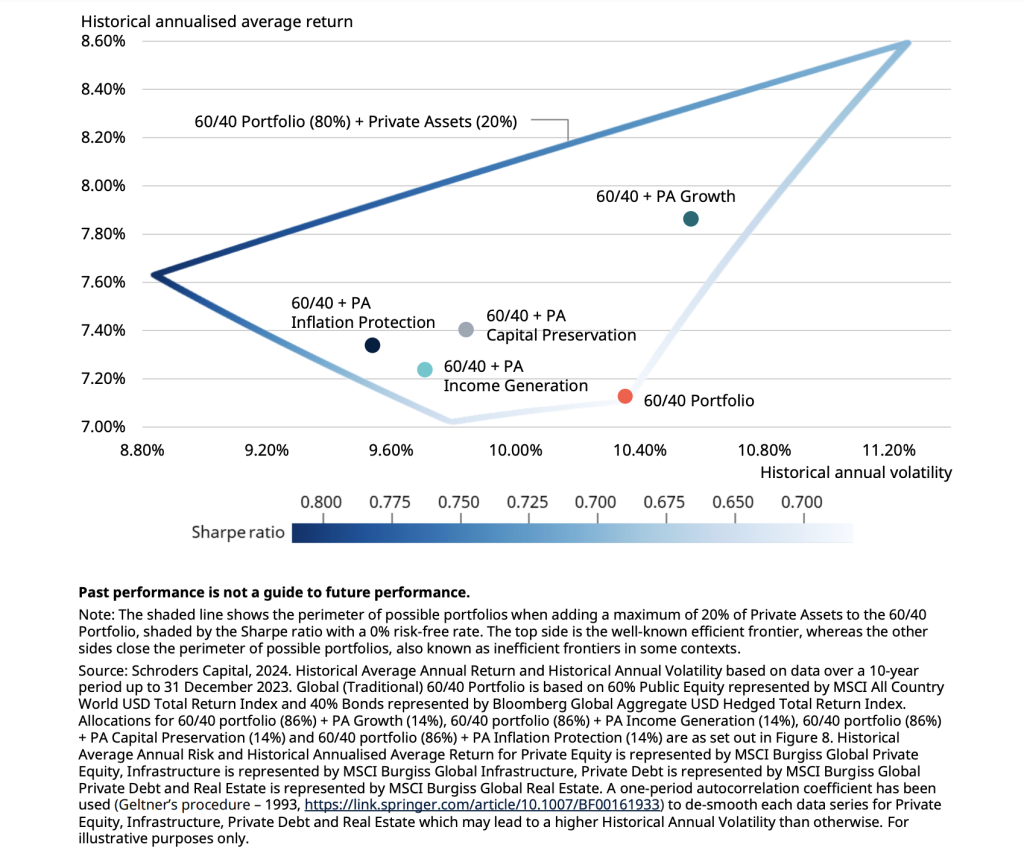

Portfolios with private market assets have a higher efficient frontier than one without private assets

For the same level of risk, a portfolio including private market assets has higher returns than a portfolio without private assets.

Higher returns with private markets versus public-only portfolios (source: Schroders Capital)

Private markets often deliver higher potential returns, enhanced portfolio diversification, and exposure to innovative and fast-growing sectors.

As private assets tend to be less correlated with public markets, tokenization of these assets supports the reduction of overall volatility while accessing long-term value creation opportunities that public markets can’t always capture.